The open enrollment for January 1 coverage ended on December 15, 2022 for the 2023 Benefit year with the Department of Health and Human Services releasing the 2024 Notice of Benefit and Payment Parameters Proposed Rule for the Affordable Care Act. This notice, with the additional notice in April of 2022, gives health plans a lot to think about for both 2023 and 2024 benefit years. Not only did HHS publish new parameters, but also added new diagnoses into the 2022 RA model algorithm.

In April of this year, the HHS notice on Benefit and Payment Parameters for 2023 final rule pushed health plans into enhancing consumer options and choice, advancing health equity by standardizing plan options, and lowering premiums while strengthening the market. With the new notice, CMS is proposing a new rule aimed to increase consumer access to healthcare services (including behavioral health) and improve the plan selection process to make it easier for members to enroll in coverage.

April 2022 HHS Notice of Benefit and Payment Parameters for 2023 Final Rule Fact Sheet

By enhancing consumer options and choice, HHS has started with standardizing plan option, advancing health equity, and actuarial value (AV) de Minimis Ranges. Starting this year, CMS will start to evaluate health plans on the new quantitative network adequacy standards. But in the 2024 plan year, health plans will need to submit a justification if they are unable to meet the standards and a plan towards how they will rectify it.

In the same breath, CMS also finalized the requirements around providers participating in telehealth services within their network. This may be the beginning of a trend to add more scrutiny to the use of telehealth services. The regulations were relaxed during the COVID grace period, but with the possible revisions to the Risk Adjustment Data Validation (RADV) process, health plans should be monitoring telehealth activity.

Lastly, with the changes to the AV de Minimis Ranges, enrollees may benefit by seeing an increase in their premium tax credits moving forward.

December 2022 HHS Notice of Benefit and Payment Parameters for 2024 Proposed Rule

The proposed changes in the latest Benefit and Payment notice, in conjunction with April’s release to expand the Network Adequacy requirements, would increase provider choice, advance health equity, and expand access to care for consumers who have low income or suffer from complex and/or chronic healthcare conditions. These new conditions would also help those who reside in underserved areas, since these consumers are often negatively affected by unanticipated costs associated with limited access to providers and provider network status per CMS. Additionally, CMS is proposing a limited amount of standardized plans which include stand-alone dental plans and the benefits to cover Mental Health facilities and Substance Use Disorder Treatment centers.

2022 Benefit Year HHS RA Model

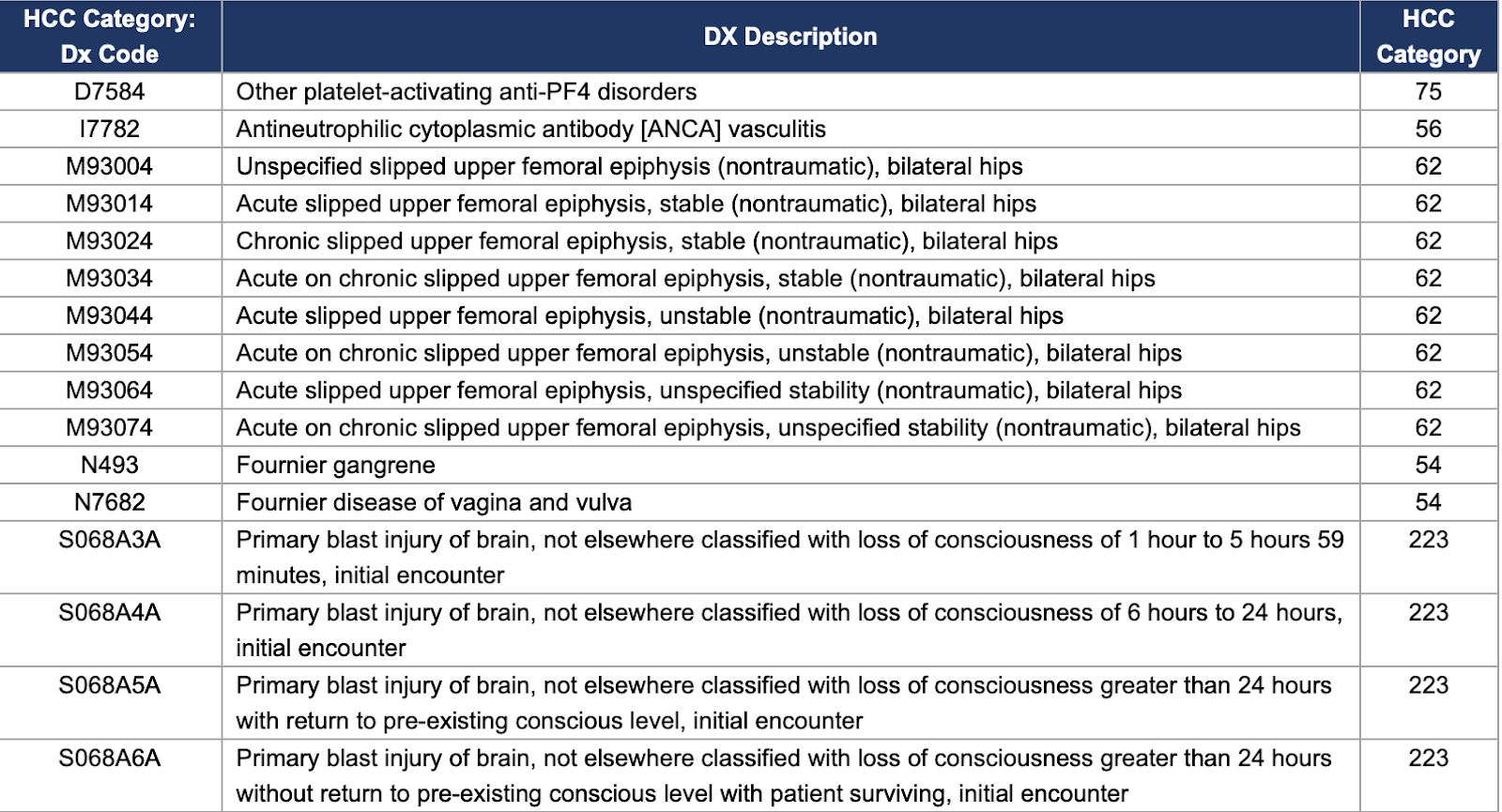

CMS posted an updated version of the draft 2022 Benefit Year Risk Adjustment Model Algorithm “Do It Yourself” (DIY) Software December 29, 2022 and updated the REGTAP library on January 9. The HHS 2022 model includes new diagnosis additions mapped to around five different HHS-HCCs. The current HCC model has 12,241 conditions, with 16 new diagnoses additions.

In the April and December notices, CMS finalized two of the three proposed model specification changes to the risk adjustment models, improving risk prediction for the lowest and highest risk enrollees in hopes of strengthening the market and stabilizing premiums. Starting with the 2023 benefit year, CMS finalized removing the current severity illness factors from the adult models to add an interacted hierarchical condition category (HCC) count model specification to the adult and child models. This will replace the current enrollment duration factors in the adult models with HCC-contingent enrollment duration factors to improve prediction for partial-year enrollees. CMS feels these model changes will continue to improve the risk adjustment program’s ability to predict and balance payments for risk across the commercial markets.

For the 2024 benefit year risk adjustment models, CMS has requested comments on whether to add a new payment HCC for gender dysphoria to the risk adjustment models for future benefit years. It is recommended that health plans review and make suggestions when appropriate.

New Additions:

Summary Report on Permanent Risk Adjustment Transfers for the 2021 Benefit Year

When the Affordable Care Act (ACA) was signed into law, it introduced a zero-sum funding model where health plans serving healthier populations make annual transfer payments to plans with relatively sicker members. On July 19, 2022, the CMS released their report on risk adjustment transfer payments for the 2021 benefit years. HHS also released the 2019 and 2022 Benefit Year Risk Adjustment Data Validation Adjustments to Risk Adjustment transfer on November 16, 2022. Let’s take a look at the report and what it tells us about the ACA marketplace.

The Impact of HRADV

The Department of Health and Human Services began their Risk Adjustment Data Validation (HRADV) process to validate the accuracy of the data submitted for transfer calculations. This validation bolsters the integrity of the department’s risk adjustment programs. HRADV can have a significant impact on the final transfer payments.

For the 2019 benefit year, 85 state market risk pools were affected by outliers detected during HRADV. That number dropped to 76 state market risk pools for the 2020 benefit year. After averaging outlier issuers for the two years, a total of 102 state market risk pools will have 2020 benefit year risk scores and state transfers adjusted up or down due to outlier issues. For reference, only 59 state market risk pools saw adjustments for the 2019 benefit year.

High-Cost Risk Pool (HCRP)

The high-cost risk pool helps ensure that risk adjustment models and state transfers better reflect the average actuarial risk, while also providing protection to issuers with exceptionally high-cost enrollees. The 2021 benefit year is the fourth year that the HHS-operated risk adjustment methodology included the high-cost risk pool, which helps mitigate any residual incentive for risk selection to avoid high-cost enrollees, and to ensure that the average actuarial risk of a plan with high-cost enrollees is better reflected in total state transfers.

For the 2021 benefit year, the high-cost risk pool reimburses issuers for 60% of an enrollee’s aggregated paid claims costs exceeding $1 million. To fund these payments, the high-cost risk pool collects a charge from issuers of risk adjustment covered plans that is a small percent of an issuer’s total premiums.

Over 53% of the 315 Individual issuers and 33% of the 453 Small Group issuers nationwide will receive a high-cost risk pool payment for the 2021 benefit year. The high-cost risk pool charge was 0.31% of premium for the individual market (including catastrophic, non-catastrophic, and merged market plans), and 0.49% of premium for the small group market, nationally.

What Changed for 2021 Payments Distribution?

According to CMS risk adjustment transfers for the 2021 benefit year, the risk adjustment methodology continues to compensate issuers that enroll higher risk individuals and to guard against adverse selection within a market and within a state. A total of 572 issuers participated in the risk adjustment program for the 2021 benefit year, down slightly from 576 issuers in 2020. Blue Plans continue to be the greatest beneficiaries in the individual market, receiving more than $2 billion in total transfer payments in the individual market.

Nationwide, the absolute value of risk adjustment state transfers across all state market risk pools (excluding the high-cost risk pool) was about 8.7% of total premiums, slightly higher than 2020 benefit year transfers, which was 7.4% of total premiums.

Risk scores increased between 2020 and 2021. In the 2021 benefit year, risk scores increased nationally by approximately 4.5% in the individual non-catastrophic risk pool and increased by approximately 4.4% in the small group risk pool when compared to the 2020 benefit year risk scores. Most metal levels, as well as a majority of states, saw small increases in the state average risk score in the individual non-catastrophic risk pool from 2020 to 2021.

For the 2021 benefit year, the top five recipients of transfer dollars are:

- Blue Cross and Blue Shield of Florida ($1.141 billion)

- Blue Shield of California ($1.032 billion)

- Blue Cross Blue Shield of Texas ($498 million)

- Community Health Choice ($185 million)

- Blue Cross Blue Shield of Illinois ($158 million)

Meanwhile, the top five payers of transfer dollars are:

- Bright Health Insurance Company of Florida (-$688 million)

- Molina Healthcare of Texas (-$566 million)

- Kaiser Foundation Health Plan (-$489 million)

- Oscar Insurance Company of Florida (-$426 million)

- Bright Health Company of North Carolina (-$146 million)

Key Takeaways

What should the commercial market do with this data? Consider these next steps:

- While big dollars are eye-catching, comparing your organization’s results to the other issuers in your particular markets on a per-member per-month basis offers a more accurate assessment of how you are performing. Remember that the high transfer numbers are a result of several factors, not the least of which is issuers’ excellence in performing underlying data submittal and risk adjustment enhancement activities. Rigorous HCC analytics and medical record coding can drive risk score gains, and even small changes in risk scores can have a large impact on the formula and associated transfer amount. Plans should also make sure they use coding results to enrich their future projects with both coder and provider education. There’s no question that if plans invest more effort, they see better results.

- HRADV audits will continue to require extensive preparation. To better prepare, plans should continue to have a proactive approach to validating their data and its sources. Many plans have debated conducting an internal audit or mock RADV since it is labor intensive, incurs additional administrative cost, and does not guarantee that the validated diagnoses will be the same ones chosen in an HRADV. While this may be true, it still helps identify risks and could minimize any potential risk to a health plan’s future financial stability. It is recommended to have a centralized team to track all regulatory changes and meet monthly across different teams to identify impact to current programs.

- To be accurately paid under the latest payment formula, plans need to accurately submit as close as possible to 100% of their claims. The 90% threshold set by CMS is a minimum target, and every issuer should benchmark to reach a higher level, especially year over year. Remember to double check enrollment datasets match throughout the company so the health plan is submitting 100% of their enrollment.

- Members with high dollar claim amounts need to be tracked and claims acceptance rates need to be prioritized to qualify for HCRP as Risk Adjustment status of the claim is given a high priority. It is recommended that the health plan create or have their vendor support reporting on these types of members to improve the submissions to HHS.

- The regulatory space in risk adjustment has been in flux since the beginning of COVID. It is recommended that health plans create an internal team to document and lead the discussion on any CMS/HHS changes and how they might impact their processes. This proactive approach will reduce the risk of rejected enrollees and claims.

- One example involves the regulatory changes in how mother-baby claims are submitted since the ACA’s inception. Members with new babies and newborn claims in a benefit year often result in breakdown of the enrollment dates and we frequently see instances where the enrollment dates overlap, causing rejections. This results in orphan claims and lost revenue if any.

- Another example is the addition of NDC codes into the ACA model. Pharmacy claims need to constantly monitor the usage of the NDC codes as health plans do submit a significant portion of the claims with non-NDC codes, which potentially impacts their RA status.

Visit our blog to learn more.